Getsafe Insights H1 2019

Beyond policies and claims: insurance as a life companion

When we started Getsafe, we never had the illusion that an insurance policy could get anyone excited. What got us intrigued though is that there are few business models in which fundamental interests of customers and companies can be so well aligned. As an insurance company, we share your deepest interest to safeguard the people and things you care most about in life. If something bad happens, we suffer with you, as we have to pay for the damage. That’s why Getsafe is about much more than filing claims in seconds.

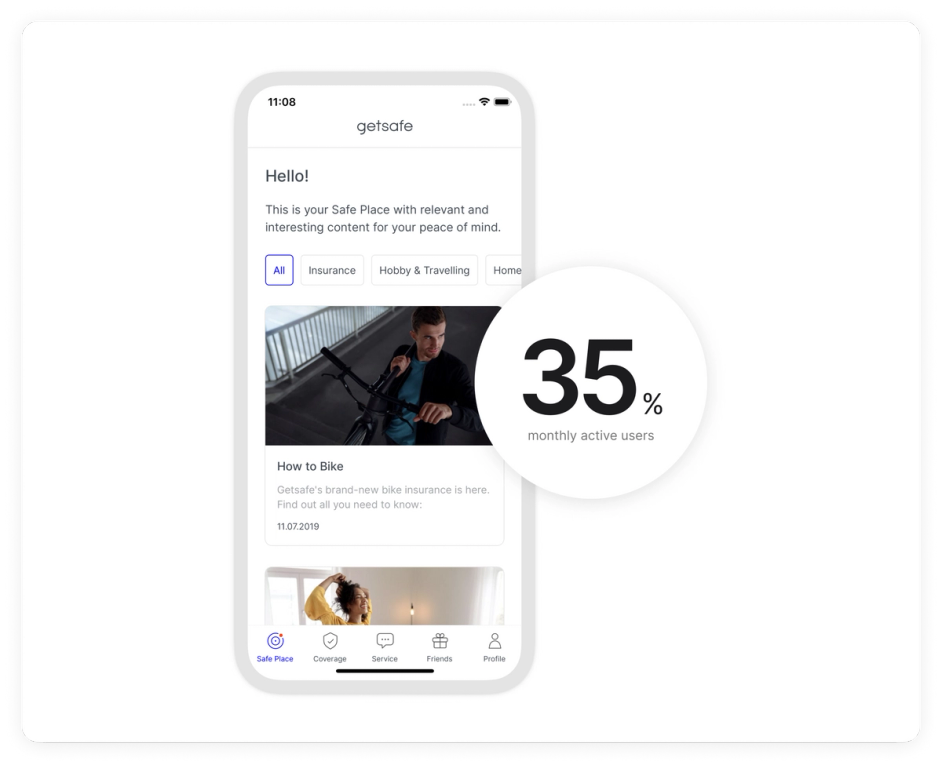

We are incredibly proud to see that our members value our approach. 35% of users keep coming back to our app every month to identify, organize and protect what they care most about in life. This level of engagement has never happened in insurance before. Here’s why Getsafe is different.

An insurance company built for the smartphone

We designed Getsafe to be an app that people can easily integrate in their daily life. In the first six months of 2019 alone, it was used 350,000 times. A 4.7 stars rating in the App store proves that our members are very satisfied with the experience we have created. As you can see below, we take the mobile-first approach as serious as no one else in the industry, not even other new digital players.

We introduced Safe Place to become a true life companion

Safe Place is our brand new app home screen that offers personalized advice, services, and exclusive benefits to support you identifying, organizing and protecting what you care most about in life. A third of our members use this feature every month.

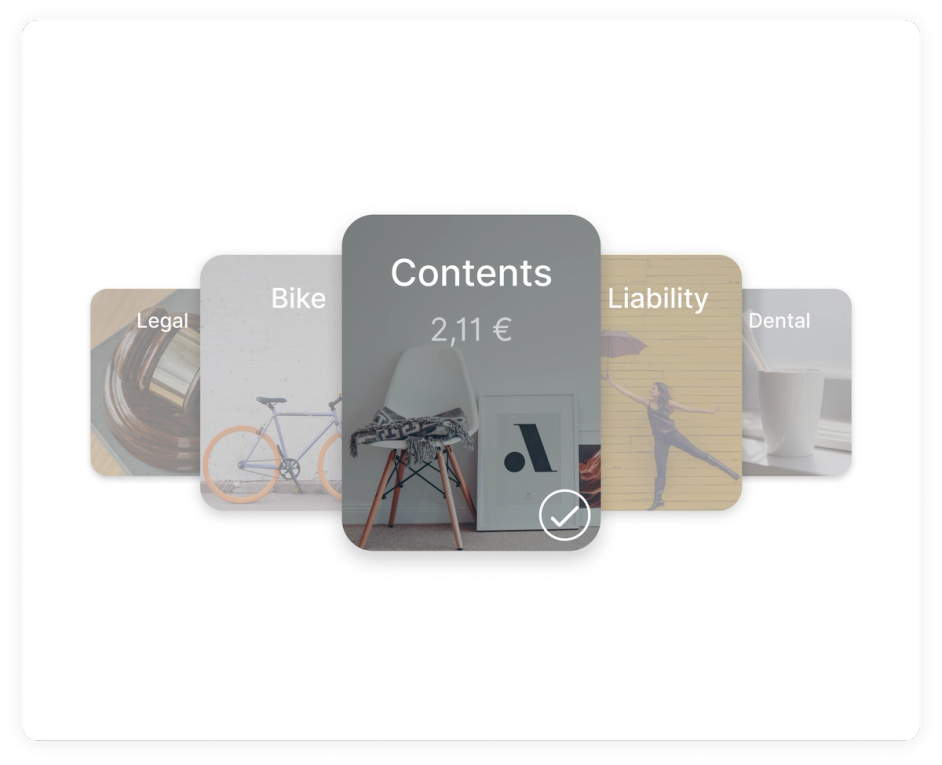

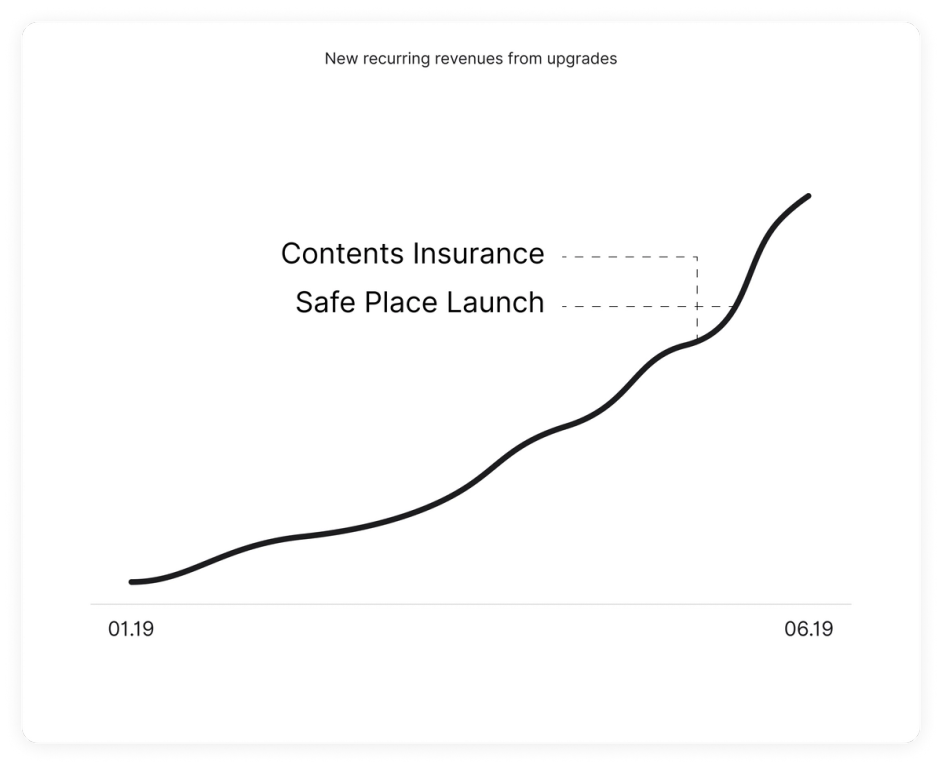

We help you protect all facets of your life

Life is beautiful when everything you care about is safe – and we are committed to help you protect it. Developing a holistic product proposition takes time, but our offering is steadily growing. This May we introduced the Getsafe contents and the Getsafe bike insurance. Our members love to upgrade their coverage – 1/3 of our premium is now coming from members buying additional coverage in the app fully automatically. This means a 4x increase over the last 10 months. In total, we currently have more than 80,000 active insurance policies.

We partnered with the best

In May we announced our Series A financing and we welcomed Earlybird as a new investor. Earlybird is known for being a true technology investor helping to shape brands of the future. They were one of the initial supporters of N26, currently one of the most successful global banks of our generation. We are proud to be part of the Earlybird family!

These first six months have shown us once more that we can shape the future of insurance. With a team of more than 60 people, we have created a unique experience for a new generation of insurance customers. As an insurance company, it’s not only about policies and claims – it’s about building trust and engagement between the lines. This is what drives us.